The difference between receipts and disbursals is the net accretion to the public debt. The total of all bonds and other debt owed by a government.

National Debt Of The United States Wikipedia

National Debt Of The United States Wikipedia

Public debt allows governments to raise funds to grow their economy or pay for services.

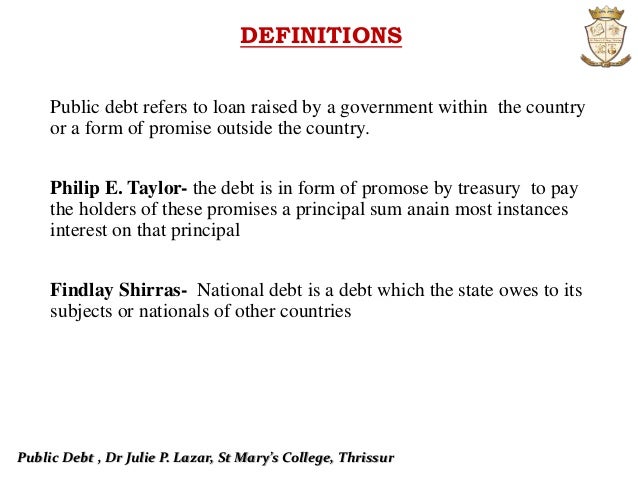

What is public debt. Thus public debt refers to loans incurred by the government to finance its activities when other sources of public income fail to meet the requirements. To allow comparisons over the years public debt is often expressed as a ratio to gross domestic product GDP. Public debt management is the process of establishing and executing an effective policy for managing public debt portfolio in order to raise required amount of funding achieve cost and risk objectives and to meet other goals such as developing and maintaining an efficient debt market.

When public debt reaches 77 of GDP or higher the debt begins to slow growth. Debts of local and state and national governments. Prudent management of public debt can.

The total debt and per capita amounts have been calculated in the table below using the GDP PPP and population figures from the same report. There are different types of public debt but the majority of the debt is from government-issued debt securities. Public debt which is also sometimes referred to as government debt is all of the money owed at any given time by any branch of the government.

Public debt is the amount of debt owed by a sovereign government to its creditors. Public debt obligations of governments particularly those evidenced by securities to pay certain sums to the holders at some future time. 2003-2012 Princeton University Farlex Inc.

Public debt sometimes also referred to as government debt represents the total outstanding debt bonds and other securities of a countrys central government. Gross public debt and net public debt terms are very similar. Public debt is an amount of money usually owed to citizens and institutions who lent the government money by buying governmental bonds for example.

Debt means borrowing of funds from another. Politicians prefer to raise public debt rather than raise taxes. Public debt is distinguished from private debt which consists of the obligations of individuals business firms and nongovernmental organizations.

It carries with them the promises of the government to pay interest to the holders of these bonds at stipulated rates at regular intervals or in lump sum at the end of the period in addition to the principal amount. Public Debt is the money owed by the Union government while private debt comprises of all the loans raised by private companies corporate sector and individuals such as home loans auto loans. Most of the time the national debt comes from bonds and other debt securities but some countries in the developing world borrow directly from international institutions such as the World Bank.

Public debt can be split into internal money borrowed within the country and. An indicator of how much public spending is financed by borrowing instead of taxation debt - money or goods or services owed by one person to another Based on WordNet 30 Farlex clipart collection. In this wider sense the proceeds of such public borrowing constitute public income.

Public debt is the total amount including total liabilities borrowed by the government to meet its development budget. It has to be paid from the Consolidated Fund of India. It also includes the outstanding external debt.

Public debt receipts and public debt disbursals are borrowings and repayments during the year respectively by the government. Definition of Public Debt. Public debt is the total of all borrowing of a government minus repayments denominated in a countrys home currency.

Public debt therefore refers to an amount borrowed by the government from it public or from foreign agencies to meet the deficit of public revenue and public expenditure. It encompasses debt owed by the federal government the state government and even the municipal and local government. Public debt - the total of the nations debts.

It is often expressed as a ratio of Public debt can be raised both externally and internally where external debt is the debt owed to lenders outside the country and internal debt represents the governments obligations to domestic lenders. In India public debt refers to a part of the total borrowings by the Union Government which includes such items as market loans special bearer bonds treasury bills and special loans and securities issued by the Reserve Bank. The United States public debt as a percentage of GDP reached its highest level during Harry Trumans first presidential term during and after World War II.

This is generally in the form of bonds. Read More on This Topic. Thus government resorts to this source of finance only when the expenditure of the government exceeds the public revenue.

3 External debt is usually in foreign currency A countrys external debt will usually be in foreign currency whereas the public debt will be in the countrys own currency. Public debt is the income of the government. CIAs World Factbook lists the debt as a percentage of GDP.

The public debt is the amount of money that a government owes to outside debtors.